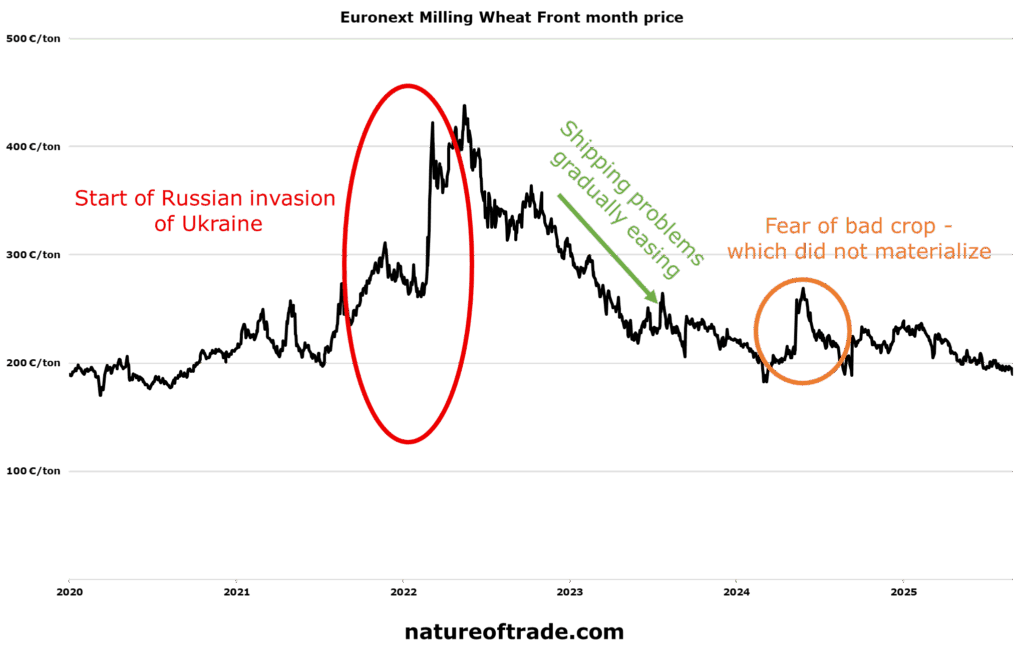

Farmers eagerly anticipated 2025 hoping for a return to the high prices seen before 2024. But it increasingly looks like they will be left disappointed.

Harvest season is more or less over in the Northern Hemisphere. Despite late droughts negatively impacting crop yields, the power of overproduction continues to push prices lower month by month. Buyers are bidding down – not up – and looks like the situation is here to stay for the rest of the decade.

As of August 2025 the Euronext futures shows a mostly flat price curve. Mills and consumers may see inflation concerns ease (though the price of wheat has only minimal impact on end product prices), but producers are far from happy. The same price as 5 years ago with input costs rising is never a good omen.

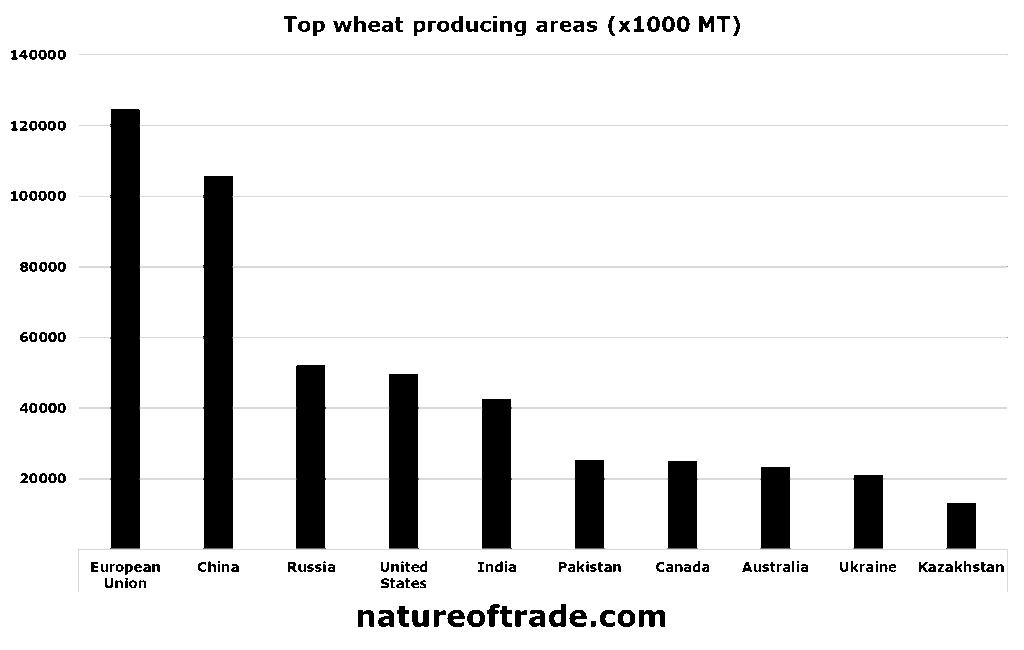

I’ve used a 10-year production average between 2011-2021 to plot the top producing countries. The reason I quoted some older data on production is because the statistics are a bit murky after the start of the Russo-Ukrainian war. Regardless, it is clear that the Eurasian plains (Kazakhstan, Ukraine & Russia) are not to be ignored by the market. These are the countries that can still see further growth from intensive agriculture and technology and Ukraine was on this yield growth trend before crisis hit the nation. So it is reasonable to assume that if weather and geopolitics align they can get the quantity to global markets. Then a sub-200€/ton price is almost guaranteed.

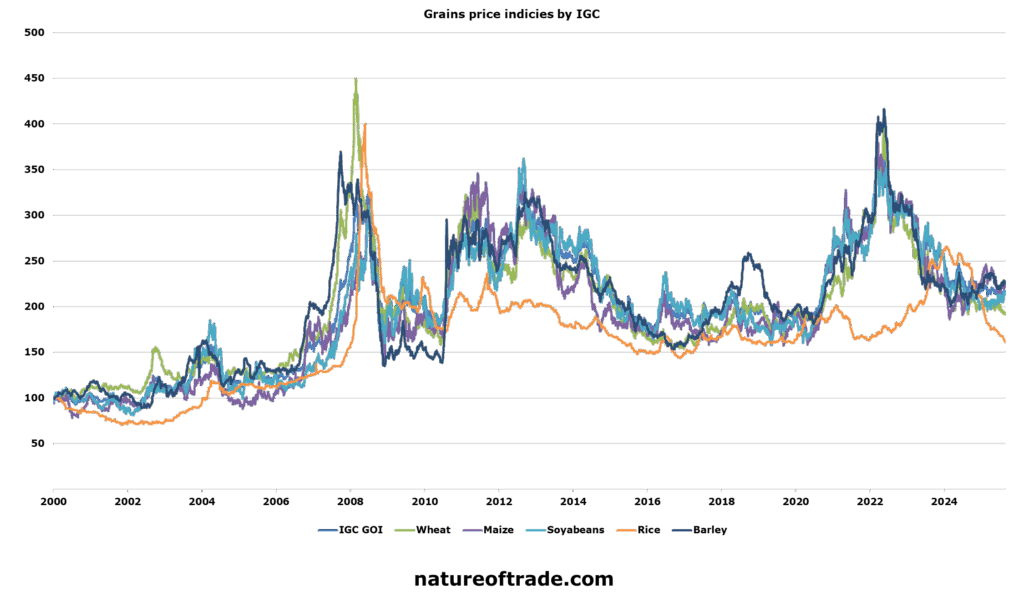

The IGC has a pretty informative index. Apart from rice, mot grain prices are highly correlated. Not sure what’s up with barley – it’s occasional differing price may be explained by volatility from demand? If you know the reason please do leave the solution in the comments.

Climate is changing, but green doomsayers are so far proven wrong by produce flooding the world. Wheat is a pretty resilient crop. Of course when looking into premium wheat the picture is not as bright. There may be opportunities for low-volume farmers to produce more valuable variants. But overall the market might have to come to term with the fact that wheat was with us and will be with us as a cheap commodity with stable low prices. The past few years were outliers, not the norm.

Cover image credit: Igor Sporynin